When selling property in Mexico, especially after years of Capital gains, you may be subject to capital gains tax (ISR – Impuesto Sobre la Renta). But did you know that there are legal ways to reduce or even avoid this tax entirely? Whether you’re an expat, a retiree, or an investor, understanding the fiscal landscape is key to optimizing your return on Real estate in Puerto Morelos or other beach destinations.

What Is Capital Gains Tax in Mexico?

Capital gains tax applies when you sell a property for more than what you originally paid. In Mexico, this tax can range from 20% to 35% of the gain. However, several legal exemptions and deductions are available — especially if you plan ahead with the right documentation and guidance.

You can review tax obligations and updates directly at the Servicio de Administración Tributaria en gob.mx.

Legal Ways to Reduce or Avoid Capital Gains Tax

1. Primary Residence Exemption

If the property you’re selling is your official residence (residencia habitual) and you’ve lived in it for at least 3 years, you may qualify for a full or partial exemption. You’ll need:

- Proof of Mexican residency (temporary or permanent)

- Utility bills in your name

- CURP and RFC registration

2. Cost-Based Deductions

You can deduct:

- Purchase costs (recorded in deed)

- Notary fees and transfer taxes

- Officially invoiced improvements (remodeling, expansions)

These deductions reduce your taxable gain and must be backed by electronic invoices (facturas) issued by authorized contractors.

According to Forbes México, proper documentation and local legal support can help foreign sellers save thousands of dollars in taxes.

Why Planning Matters for Foreign Sellers

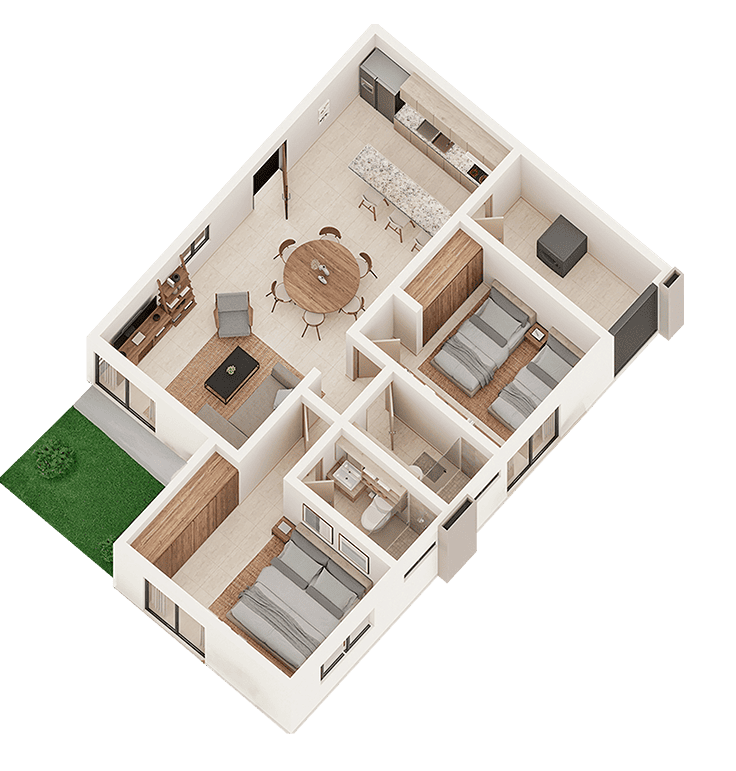

For foreigners, tax planning should start at the time of purchase — not when you’re ready to sell. Choosing the right property, such as Condos for sale in a planned community, and consulting with a notary or tax specialist from day one can preserve more of your capital gains.

If your goal is to Investing in real estate and sell for profit later, a long-term strategy will ensure better results, especially in markets with high Capital gains like Puerto Morelos.

Selling property in Mexico can be highly profitable, but smart planning makes all the difference. By taking advantage of primary residence exemptions, expense deductions, and legal structuring, you can legally reduce or avoid capital gains tax. Whether your motivation is investment or Beach living, keeping more of your earnings means more freedom for your next opportunity.