If you plan to generate income by renting a condo in destinations like Puerto Morelos, whether as a Mexican resident or a foreign investor, it’s essential to understand your fiscal responsibilities. Being informed will help you operate legally and get the most out of your real estate investment in the Riviera Maya.

Do I Have to Pay Taxes When I Rent Out My Property in Mexico?

Yes. Anyone earning income in Mexico—resident or not—is required to pay taxes. This includes short-term or long-term rentals of real estate located in the country.

For vacation rentals (such as those listed on Airbnb or Booking.com), the income must be reported to the Mexican Tax Authority (SAT), even if you live abroad.

Tax Obligations for Mexican Nationals

If you’re a Mexican citizen and renting out your property, you must:

- Register with the SAT under the rental income regime (arrendamiento)

- Issue electronic invoices (CFDI)

- Declare your income and pay Income Tax (ISR) and in some cases, Value-Added Tax (IVA)

- File monthly and annual tax returns

You can also deduct certain operational expenses such as:

- Maintenance

- Property management fees

- Utilities

- Advertising costs

What If I’m a Foreign Investor?

Even if you’re not a resident, you must comply with tax obligations when renting out property in Mexico.

It is highly recommended to hire a legal representative or accountant in Mexico to assist with:

- Getting a Mexican Tax ID (RFC) as a non-resident individual

- Paying the corresponding taxes and filing returns

- Managing legal reporting requirements

In some cases, income generated through digital platforms is automatically withheld and reported to the SAT—only if the platform is registered with the tax authority.

You can find more information through ProMéxico or directly on the SAT’s official website for foreign taxpayers.

How Does This Affect My Investment?

Being compliant with Mexican tax laws not only avoids penalties, it also protects your investment:

- It simplifies the future resale process

- It helps you avoid fines or legal issues

- It lets you deduct costs and maximize net profits

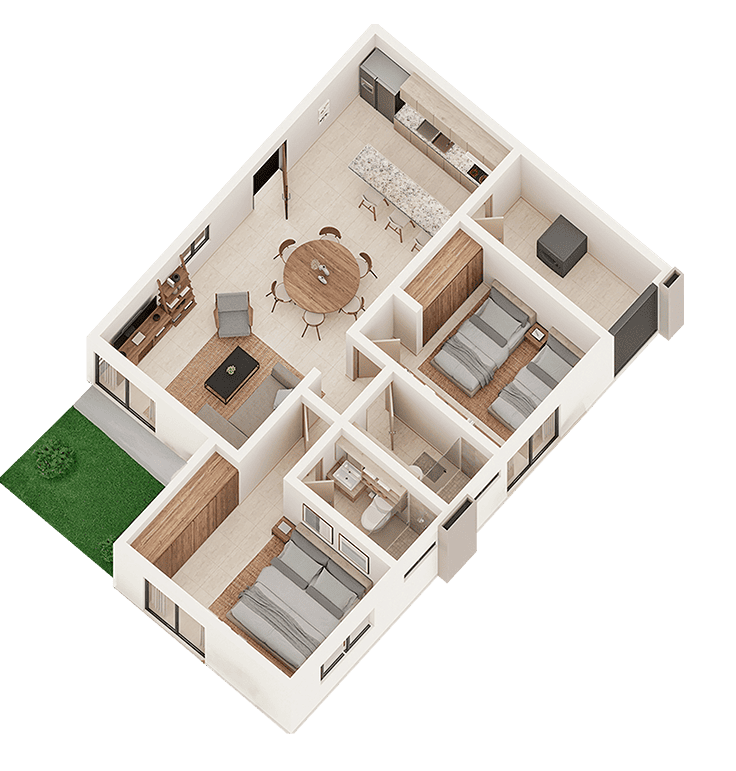

Plus, developments like Selva Escondida II in Puerto Morelos offer ideal layouts and amenities for vacation rentals, making your property even more attractive to guests.

Whether you’re a Mexican national or a foreign investor, meeting your fiscal obligations when renting your property in Mexico is crucial for long-term success. Getting the right advice from the beginning allows you to operate legally, avoid risks, and earn passive income while your property gains capital appreciation.

👉 Want to learn more? Visit https://selvaescondida.mx